Minimal Liquidity: Lots of the alternative assets which can be held within an SDIRA, which include real estate property, private fairness, or precious metals, is probably not very easily liquidated. This may be an issue if you need to accessibility cash rapidly.

And since some SDIRAs such as self-directed traditional IRAs are issue to demanded least distributions (RMDs), you’ll ought to program in advance to make certain you've ample liquidity to satisfy The principles established through the IRS.

An SDIRA custodian is different since they have the suitable staff, abilities, and capacity to maintain custody with the alternative investments. The first step in opening a self-directed IRA is to find a company that's specialized in administering accounts for alternative investments.

Complexity and Responsibility: With the SDIRA, you've a lot more Manage more than your investments, but In addition, you bear far more duty.

The tax strengths are what make SDIRAs eye-catching For numerous. An SDIRA is often the two conventional or Roth - the account type you decide on will depend mostly on your investment and tax tactic. Examine with your money advisor or tax advisor should you’re Doubtful which can be most effective to suit your needs.

Research: It can be called "self-directed" for any explanation. By having an SDIRA, you're totally chargeable for completely studying and vetting investments.

Feel your Pal could be beginning the next Fb or Uber? With an SDIRA, you could put money into leads to that you suspect in; and possibly enjoy better returns.

Yes, real estate property is one of our purchasers’ most popular investments, from time to time referred to as a housing IRA. Customers have the option to speculate in every thing from rental Qualities, commercial real-estate, undeveloped land, mortgage notes and much more.

As an investor, even so, your options are usually not limited to shares and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

As a result, they have an inclination not to advertise self-directed IRAs, which supply the flexibleness to invest within a broader selection of assets.

Should you’re hunting for a ‘established and ignore’ investing technique, an SDIRA almost certainly isn’t the appropriate decision. As you are in full Command around each investment produced, It is your choice to perform your own private homework. Remember, SDIRA custodians usually are not fiduciaries and cannot make suggestions about investments.

Customer Assist: Search for a company that offers devoted aid, like access to proficient specialists who will answer questions on compliance and IRS guidelines.

Property is one home of the most popular choices amid SDIRA holders. That’s because you'll be able to put money into any type of property that has a self-directed IRA.

The key SDIRA rules with the IRS that investors will need to be aware of are investment constraints, disqualified folks, and prohibited transactions. Account holders must abide by SDIRA procedures and rules to be able to protect the tax-advantaged status of their account.

From time to time, the service fees associated with SDIRAs could be increased plus much more sophisticated than with a daily IRA. It's because with the amplified complexity affiliated with administering the account.

Selection of Investment Solutions: Make sure the provider permits the categories of alternative investments you’re keen on, like real-estate, precious metals, or personal fairness.

Transferring resources from one form of account to another variety of account, such as transferring resources from the 401(k) to a traditional IRA.

Quite a few traders are amazed to learn that utilizing retirement money to speculate in alternative assets has long been achievable since 1974. Nonetheless, most brokerage firms and banks deal with giving publicly traded securities, like shares and bonds, as they absence the infrastructure and expertise to control privately held assets, for instance real estate property or private fairness.

IRAs held at banking institutions and brokerage firms offer minimal investment possibilities for their consumers since they would not have the experience or infrastructure to administer alternative assets.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Jeremy Miller Then & Now!

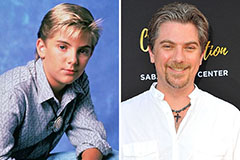

Jeremy Miller Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!